The only time many of us think of our car insurance policy is when there misbehaves information, like a ticket or a mishap. When you're young, solitary as well as incident-prone, rates just seem to go one means: up. There is a flip side. Tickets diminish your record, as well as so do mishaps.

All of these events will certainly influence your auto insurance coverage rates in a great way. insurance. Trick TAKEAWAYSCar insurance coverage premiums can raise for various reasons, yet there are several points you can do to offset the rises. Some large life modifications, like buying a home and getting wed can reduce automobile insurance coverage expenses.

IN THIS ARTICLELife occurs: 16 ways to minimize car insurance coverage, If you do not intend to wait for your vehicle insurance prices to drop, the great information is that there are actions you can take now to reduce automobile insurance (insurance). Need to know even more? Below are 16 various methods to try.

Since you're older as well as better, you don't have to be stuck to the exact same high price - laws. As a matter of fact, you do not need to stick with the exact same insurance coverage firm. Occasionally searching for the very best deal on vehicle insurance coverage is an excellent means to pay less. Today, it's easy to compare quotes online - cheaper car.

Get price cuts for installing anti-theft tools, Cars and truck insurance provider enjoy to supply price cuts to clients who take steps to decrease their danger as vehicle drivers - cheaper cars. One way to do that is by mounting tools that can discourage burglars or make your automobile less complicated to recoup if it is swiped, such as a vehicle alarm or GPS monitoring.

Insurance companies love statistics, and also information shows that wed vehicle drivers get in less accidents. Wedded people also have a tendency to bend up regularly and also obey the rules of the roadway. Some cost savings come as you integrate plans as well as get multi-car insurance coverage. cheap car. Nonetheless, also you marry a spouse that doesn't drive, your prices can still drop significantly around generally (car).

The Definitive Guide for 6 Reasons Why Auto Insurance Costs More For Young Drivers ...

Ask your car insurance policy company what kinds of fondness group price cuts it provides - vehicle insurance. Avoid month-to-month costs settlements, Setting up your vehicle insurance policy premium to be billed monthly may be simpler to budget plan, however if you can pay for to pay a bigger piece at once, it could save you money (insurance).

Get a house, Insurers consider house owners more secure than renters, so most will discount your rate, no matter whether you insure your house with them or otherwise. The discount rate amount will vary; nationally, it standards around. Much more severe financial savings originated from bundling your house and vehicle insurance policy. The savings typically are reflected in your vehicle insurance expense.

Transfer to a town, If you choose to ditch the large city for a town with more room and also less people, it might profit your auto insurance coverage rate, as well. Beyond your very own driving Click here! document, few things have much more effect on auto insurance coverage than your ZIP code - cheapest car insurance. Less populace density typically means less crashes.

It doesn't occur overnight, but it does occur, Huge adjustments in your life normally imply huge adjustments in your insurance coverage. "It's not typically one firm will certainly offer the very best sell all situations," claims Penny Gusner, elderly customer expert for Insurance coverage. com - dui. That's why it's an excellent idea to shop about for insurance policy and also ensure you're obtaining the best offer.

cheapest car car insurance cars car insured

cheapest car car insurance cars car insured

Exactly how can I lower my vehicle insurance coverage after an accident? The problem is that if you're in an at-fault mishap, or your insurance policy company thinks you've been associated with as well many cases, your insurance coverage premium will likely go up. One at-fault case, for example, can increase your price anywhere from, depending upon the seriousness.

insurance company cheapest car car insurance business insurance

insurance company cheapest car car insurance business insurance

Your price might still boost due to losing an excellent motorist discount (low-cost auto insurance). Just how much does auto insurance drop after 1 year with no claims? If you're a safe vehicle driver and also haven't filed any insurance claims in the in 2015, your automobile insurance coverage prices may drop at renewal or might remain the very same.

Excitement About Best Auto Insurance For Under 25 Males

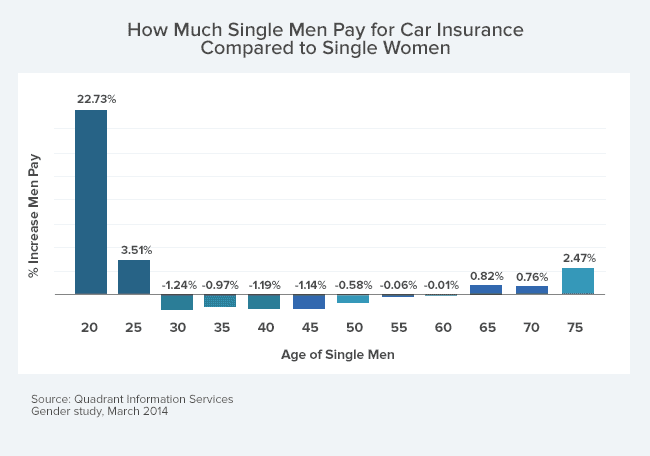

It's feasible that your vehicle insurance policy premiums can go up also if you don't have an accident or make an insurance claim throughout the whole policy term. When will my car insurance drop? Insurance business will certainly frequently reduce your prices when you turn 25, yet this is not always the case.

But if you're a secure motorist, you can see a decline in your automobile insurance coverage prices at policy renewals and also premiums may decrease even before 25 (vehicle). Why did my insurance go down? If you've been with your auto insurer for 3 or even more years, they may want to provide discounts that weren't noted throughout the quote process.

cheapest car car insurance car insured

cheapest car car insurance car insured

Yes, auto insurance policy lowers over time. You might find that your vehicle insurance rates go down as you obtain older or have teen drivers on board.

Being unskilled behind the wheel of a cars and truck typically leads to greater insurance coverage prices, however some firms still offer excellent rates. Much like finding insurance for any kind of other driver, finding the very best car insurance coverage for brand-new chauffeurs indicates studying as well as contrasting rates from carriers. In this post, we at the House Media evaluates group will certainly give you a summary of what new motorists can expect to spend for auto insurance coverage, who certifies as a brand-new chauffeur and also what variables form the cost of an insurance coverage.

Each state sets its very own minimum car insurance coverage requirements, as well as cars and truck insurance policy for new vehicle drivers will look the very same as any type of other motorist's plan. Right here are some instances of people who could be considered new vehicle drivers: Teenagers Older people without a driving record Individuals who come in to the United state

8 Easy Facts About When Does Car Insurance Go Down In Ontario - Ratelab.ca Shown

Car insurance automobile insurance policy prices Car supplier automobile new drivers can vehicle drivers widely depending extensively where you shop. Car insurance coverage for teens It can be amazing for a teenager to begin driving on their own for the very first time, however the price of auto insurance for brand-new chauffeurs is generally high.