The limitations required and also optional limitations that might be available are set by state legislation. This insurance coverage, called for by regulation in some states, covers your medical costs and those of your passengers, no matter of that was accountable for the crash. The restrictions needed and also optional limitations that might be readily available are set by state legislation (affordable car insurance).

Selecting the finest automobile insurance coverage, Getting the best level of vehicle insurance is not one dimension fits all. cheap auto insurance. What is most crucial to one cars and truck owner isn't necessary for an additional.

As well as do not fret if you want to know what the most inexpensive rates as well as best security coverages would be, we let you toggle between the outcomes for both. Just how much automobile insurance policy do I need? The auto insurance coverage calculator advises the ideal level of automobile insurance policy protection for you based upon your responses - low cost.

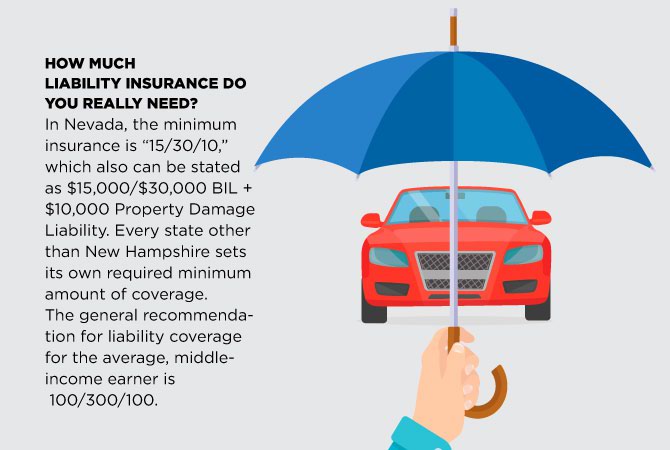

Obligation insurance coverage covers damages you may cause others in a vehicle mishap. This implies damage to their vehicle or injuries the various other chauffeur or their guests may have endured. It will additionally spend for damages you caused to somebody else's home, for circumstances if your newbie teenager motorist strikes your neighbor's fence.

Comprehensive covers your car for "various other than collision" events like theft, fire and also damage from weather occasions like flooding and hailstorm. Collision covers, no matter of mistake, if your car is harmed in a car mishap or if you roll or turn your auto by mishap. Compensation as well as accident are not required by any kind of state but is funding business if your cars and truck has a lease or lending on it (affordable car insurance).

It covers the "space" left when your insurance coverage payment is not sufficient to cover the benefit on your car. affordable. Spending for this extra protection is better than continuing paying on a cars and truck that you no longer car drive. If you enroll in gap insurance coverage, your insurance firm will establish exactly how underwater you are with your lorry worth and identify exactly how much the policy would pay.

7 Simple Techniques For Motorists Over 50 Face Car Insurance Premium Hike - Leicester ...

insurance companies car vehicle insurance cheap car

insurance companies car vehicle insurance cheap car

You place your injury asserts with your own insurance provider first in no-fault states. Just how much PIP you should carry will certainly be determined by state mandates.Uninsured/ Underinsured vehicle driver is called for in some states as a way to cover injuries you receive in an automobile mishap if the at-fault party was without insurance or underinsured. If you have a great deal of assets you could lose in a judgement, an umbrella policy is a means to shield them. It is optional coverage as well as just how much you need relies on your assets and economic situation. As you experience the auto insurance policy calculator you will certainly learn the recommended car insurance coverage coverages based on your answers. Insurer ranking systems differ so depending what protections, restrictions and deductibles you pick the business that is ideal for you will differ. It will certainly likewise differ based on your driving record and also various other rating variables that specify to your existing situation. If you wish to approximate your car insurance prices, no fears we can assist you with that said as well. You can then acquire the policy straight from Insurance policy. com, proceed to an insurance coverage provider's website or talk to a licensed insurance agent over the phone. You can also see prices by age, rates by state and also rates by business. With all of these ways to estimate and compare expenses you must have a good idea of what you ought to be paying. How to approximate car insurance coverage prior to getting a car, When you remain in the hunt for a new auto( whether it's a brand

new car or just new to you), it is vital to look around for vehicle insurance policy prices at the same time. You do not wish to locate the best cars and truck only to locate out you can manage the vehicle payments yet not the expense to guarantee it. You don't intend to lose out on essential defense for your vehicle by missing an insurance coverage. Just how much vehicle insurance do I need? Wonderful inquiry! The short as well as very easy response is: We're not stating that just to drum up service. The truth is, as well many vehicle drivers are lured right into lowball vehicle insurance prices quote that are based upon state minimums. As well as Massachusetts'required minimum limitations are frighteningly low, when you take into consideration the real price of the majority of auto crashes (more on this listed below). The website even states:"Provided the high costs related to major accidents, most chauffeurs acquire insurance coverage limits past the minimum needs." Here are some truths to aid put the numbers into point of view: The average vehicle currently sets you back a little over$31,000. High-end vehicles like Mercedes as well as BMWs set you back a bargain a lot more. Various other kinds of property(besides vehicles)can be expensive, also. Think about the various sorts of residential or commercial property that a vehicle may ram: utility pole, street lights, guardrails, mail boxes. Several of these can cost approximately hundreds of dollars in damages all on their own, as a result of the replacement product, tools, and labor involved in a repair. Comprehensive/collision are optional enhancements you can(and also must) include in your MA cars and truck insurance policy to cover the cost of damage to your car. Accident, as the name would certainly suggest, covers you for damage endured in a collision occasion. With crash insurance coverage, your policy would spend for damages up to the real cash worth of the car, minus the deductible that you select(which you would certainly require to pay out of pocket). And also much of them do not have adequate insuranceor any kind of insurance coverage in any way. Make certain you as well as your family members are effectively covered. Give us a call or submit the quick quote type today. Wondering just how a lot the expense of auto insurance will be for that stunning brand-new car you 've been fantasizing regarding? You're not the only one. As well as landing on that specific number can be challenging for a variety of factors since insurance policy rates can vary by cars and truck type as well as the age of the automobile.

Other elements like your personal economic history as well as your household's driving records can all affect the price of your premium. To much better comprehend what factors are in play, let's take an appearance at what goes right into determining the expense of car insurance and also dig deep right into the factors that guide your insurance policy costs. A lot of car insurer will have their insurance representatives accumulate details about your cars and truck when developing a quote. They'll also ask you concerning your recommended coverage limits, which can change the expense of your vehicle insurance plan. insurers. Representatives will certainly check out state-mandated coverage demands to be certain you're obtaining the security you need to drive lawfully. If you get married or divorced, it's finest to get in touch with your American Household Insurance coverage representative asquickly as feasible to let them know of the adjustment. Generally, this will imply you'll be transforming your policy, whether you're including your new partner or eliminating your ex. You may be able to conserve money on vehicle insurance policy with a great

credit history ranking. If you've not had a major crash in 5 years, this can benefit your auto premium. Furthermore, when no property damages or responsibility claims have actually been made against you in the recent past, you stand to obtain a far better price. The cost of your car and the year it was produced will be used to assist create your insurance policy rates.

The Loyal Drivers Pay The Price For Car Insurance Apathy - Your ... Diaries

The location as well as postal code where your car is signed up will have an effect on the amount you spend for insurance. Safe areas with reduced crime rates are normally associated with lower insurance prices. If you're able to pack various other policies with your auto insurance coverage, you can save money on your costs. With American Family Members Insurance policy, you may be able to conserve big. Talk to your representative to get more information regarding packing. You'll likely be asked about the method you intend to use your vehicle when you obtain car insurance. You'll be asked regarding the range you'll be driving to and also from job daily and regarding your projected annual mileage. One method you can control the expense Check out the post right here of your. cheaper car.

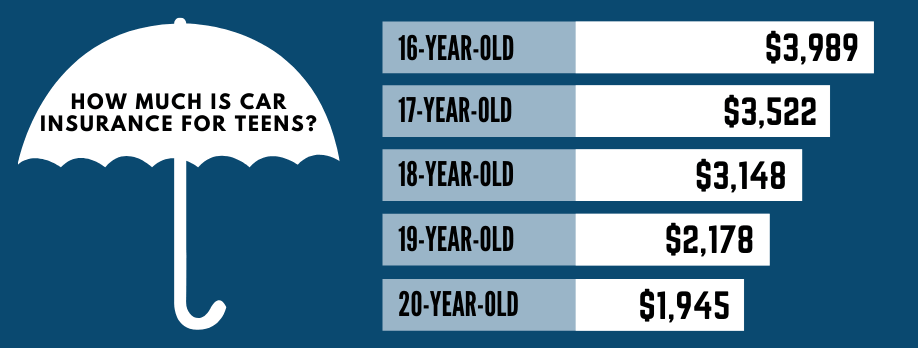

vehicle insurance policy is to request quotes on different protection limitations. By readjusting these restrictions and your insurance deductible, you ought to have the ability to discover the coverage you need. Since many states need you to purchase cars and truck insurance policy that secures versus without insurance motorists, you're going to probably require something close to full insurance coverage to accomplish those needs. If your state does not require you to have insurance coverage, adding bodily injury responsibility protection, you might be doing yourself a huge favor if you're ever found responsible for a mishap that created injuries to others. At American Family members, we'll reward you when you sign up in My Account and also select paperless invoicing. In this short article, we'll discover how typical car insurance rates by age and also state can change. We'll likewise have a look at which of the most effective cars and truck insurance firms supply excellent discounts on automobile insurance policy by age as well as compare them side-by-side. Whenever you buy cars and truck insurance coverage, we suggest getting quotes from multiple providers so you can compare coverage and also rates. Why do ordinary auto insurance coverage prices by age differ so much? Essentially, it's everything about danger. According to the Centers for Disease Control as well as Prevention(CDC), individuals between the ages of 15 as well as 19 represented 6. 5 percent of the populace in 2017 but represented 8 percent of the overall expense of vehicle mishap injuries. The rate data originates from the AAA Foundation for Traffic Security, and it accounts for any kind of crash that was reported to the police. The typical costs information comes from the Zebra's State of Vehicle Insurance policy report. The prices are for policies with 50/100/50 liability coverage limits and a$500 deductible for comprehensive and also accident coverage. According to the National Freeway Traffic Security Administration, 85-year-old guys are 40 percent most likely to enter into an accident than 75-year-old men. low-cost auto insurance. Taking a look at the table over, you can see that there is a straight connection in between the accident rate for an age group as well as that age's average insurance policy premium. Remember, you may locate better prices via one more company that doesn't have a specific student or senior discount. * The Hartford is just readily available to members of the American Organization of Retired Folks (AARP). Insurance holders can add more youthful drivers to their plan and also obtain discount rates. Average Vehicle Insurance Policy Fees As Well As Cheapest Service Provider In Each State Because car coverage rates vary a lot from one state to another, the provider that provides the most affordable auto insurance coverage in one state might not provide the cheapest insurance coverage in your state. You'll additionally see the typical price of insurance policy because state to aid you compare. The table also includes rates for Washington, D.C. These price approximates relate to 35-year-old motorists with excellent driving records and debt. As you can see, typical car insurance policy expenses vary commonly by state. Idahoans pay the least for automobile insurance policy, while motorists in Michigan pay out the huge dollars for protection. If you live in midtown Des Moines, your costs will most likely be greater than the state average. On the other hand, if you stay in upstate New York, your automobile insurance plan will likely set you back less than the state standard. Within states, car insurance costs can vary commonly city by city. The state isn't one of the most expensive overall. Minimum Protection Requirements Most states have financial duty regulations that require drivers to carry minimal cars and truck insurance policy protection. You can only forego insurance coverage in two states Virginia as well as New Hampshire yet you are still economically in charge of the damage that you cause. Some insurers may supply affordable rates if you don't use your car much. Others offer usage-based insurance coverage that might conserve you money. Insurers factor the probability of a car being taken or harmed in addition to the price of that lorry into your costs. If your auto is one that has a likelihood of being stolen, you might have to pay even more for insurance policy. Yet in others, having negative credit score could trigger the cost of your insurance costs to rise drastically. Not every state enables insurance firms to make use of the gender noted on your chauffeur's license as an establishing consider your costs. Yet in ones that do, female drivers usually pay a little much less for insurance coverage than male chauffeurs.

Why Do Automobile Insurance Policy Rates Adjustment? Looking at ordinary vehicle insurance policy rates by age and also state makes you wonder, what else affects prices? On the whole, automobile insurance coverage tends to get a lot more costly as time goes on (cheaper car).

car insurance low cost low-cost auto insurance cheaper car insurance

car insurance low cost low-cost auto insurance cheaper car insurance

credit score credit cheap auto insurance cheaper car insurance

credit score credit cheap auto insurance cheaper car insurance

vehicle car insured insurance companies cheaper auto insurance

vehicle car insured insurance companies cheaper auto insurance

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg) cheap auto insurance cheap insured car vehicle

cheap auto insurance cheap insured car vehicle

Sirijit Jongcharoenkulchai/ Eye, Em, Getty Images Exactly how much you need to pay for auto insurance varies extensively based on a selection of elements. The nationwide standard for car insurance premiums is regarding $1621 per year, and also there are states with standards much away from that figure in both directions. Typical National Costs, The overall nationwide average price of car insurance policy will differ based on the source.

Whatever the case might be, you'll most likely discover yourself paying even more than $ 100 per month for cars and truck insurance coverage. low cost. When calculating national costs, a selection of elements are consisted of.

Several insurance coverage options are offered from insurance policy business, and also the typical number requires to mirror the most common type of protection. In this case, the nationwide expense figures determine plans that consist of obligation, extensive, and also crash insurance coverage along with state-mandated insurance policy like accident defense and also without insurance driver protection. Typically, the minimum insurance policy will cost concerning$676 per year, which is almost$1000 much less than the national ordinary annually. While these standards can be useful for getting a suggestion of what insurance prices, your individual aspects have one of the most effect on the costs rates you'll get. Typical Protection Degree, Generally, people tend to choose even more coverage than the minimum that's legally called for. Typically, complete insurance coverage will set you back not even$900 per year. North Carolina and Idaho are additionally noteworthy for using inexpensive complete coverage. The most costly state for insurance policy is Michigan, and also its ordinary costs are far beyond the nationwide average. For complete insurance coverage in Michigan, you'll be paying over $4000 annually, though there are efforts to reduce this rate. Aspects Influencing Your Costs, Just how much you should be spending for your costs is mostly influenced by differing personal elements in addition to your certain place.

While any kind of variable can show just how much of a danger you will certainly be to insure as a chauffeur, one of the most crucial variables are usually the exact same throughout all insurance coverage companies, though there are exceptions. Minimum state-required protection will always be one of the most affordable, yet if you plan on marketing your car at a later date, detailed insurance coverage may be an individual need.

Age: Age plays a big function in exactly how much your costs is - vans. If you're over the age of 25 with a tidy history, your costs will mostly coincide for decades. Young adults are particularly pricey to cover, as they pose one of the most run the risk of as a result of their inexperience. Time on the roadway: The even more time you spend on the road, the higher your premiums are mosting likely to be.

How much you must pay for automobile insurance policy depends on a number of aspects all working with each other. Since of this, there is no one-size-fits-all response to your cars and truck insurance requires. The quickest means to discover out just how a lot an auto insurance plan would certainly cost you is to utilize a quote calculator tool.