At the end of 2021, lots of cars and truck insurance providers got approval to hike their rates in various states and premiums are anticipated to keep increasing this year. And with costing US families and, it's more important than ever to discover. One such method to conserve is to find a carrier with cheaper rates than what you currently have (business insurance).

And while economical policies exist, it is necessary to balance cost savings with appropriate coverage (car). If you enter a mishap, for example, you might end up paying more than you would have with much better, more pricey coverage. That said, there are economical options out there with great coverage at low rates.

Best low-cost vehicle insurance coverage business Geico's advertising presence has actually made it one of the most recognizable brand names in vehicle insurance, and this insurance service provider's rates and client service have made it one of the most beloved. car insurance. Geico notoriously informs drivers that they could conserve 15% or more by switching to the provider, but how does it provide such cost savings?

The General acknowledges that not every motorist can boast the cleanest record, which mistakes-- such as mishaps and driving infractions-- take place behind the wheel - cheapest auto insurance. Still, the business undertakings to supply affordable rates to motorists who may fall under the "nonstandard" label - cheapest car insurance. It's likewise worth keeping in mind that insurance coverage acquired through The General is financed by a number of business that have actually been recognized by AM Best with an "A" score, while The General itself has obtained an A- (excellent) score. cars.

If you can deal with an insurance business you already utilize for other insurance coverage, or an insurance company that uses unique benefits to staff members at your work environment, you can potentially conserve a lot more money on your vehicle insurance policy (affordable car insurance). You might be able to save cash on your insurance coverage premium by adjusting your coverage or deductibles, but it may be helpful to speak to an agent prior to making changes so that you much better understand how your coverage will operate in the occasion of an accident - vans.

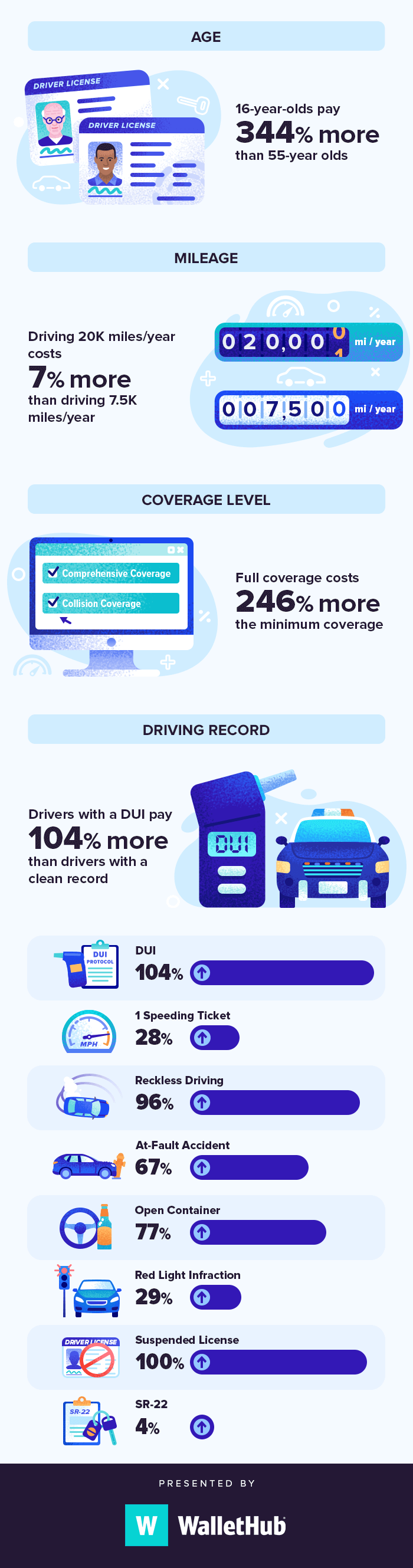

What determines your car insurance coverage rates? Aside from diverse costs from insurance service providers, lots of aspects influence the cost of your car insurance, consisting of: Your age (in all states other than Hawaii)Driving history, Credit rating (in some states)The quantity of coverage you seek How can I decrease my insurance coverage rates? Discovering a car insurer that can save you cash is necessary, but there are things you can do by yourself to ensure you conserve money on car insurance. low cost auto.

However, we might receive payment when you click links to products or services provided by our partners. insurance company.

Conserve Money with Inexpensive Car Insurance Are you looking for inexpensive car insurance coverage but worried about sacrificing quality and service in favor of a more economical rate? GEICO has you covered (insured car). The word "cheap" might be scary when it concerns a car insurance policy, but it doesn't have to be by doing this. cheapest car.

The Facts About Moneysavingexpert Multi-comparison: Car Insurance Revealed

It's inexpensive. It's great for your budget. All while supplying you with 24/7 customer care and top-of-the-line insurance for your automobile. Here at GEICO, quality doesn't fall by the wayside when it comes to providing clients with inexpensive car insurance coverage and terrific customer support. Get a complimentary car insurance coverage quote to find out how much you might conserve.

Exist risks to getting inexpensive automobile insurance? Low-cost rates ought to not mean you have to opt for limited policy coverage choices, high deductibles, poor customer support, and a lack of crucial safety functions like emergency situation roadside service - cheapest car insurance. Things are various with GEICO, where cheap cars and truck insurance doesn't change the extraordinary service, functions, and protection alternatives that our auto insurance policyholders receive (credit).

GEICO policyholders are surrounded by money-saving opportunities that can make their vehicle insurance coverage rates more cost effective.: By changing to GEICO, students could conserve $200 on a car insurance policy. We work hard to make sure "inexpensive" only explains your car insurance coverage rates and not the quality of service or your experience as an insurance policy holder.