If you have a background of having automobile insurance coverage plans without submitting insurance claims, you'll obtain more affordable prices than a person who has submitted insurance claims in the past.: Cars and trucks that are driven less regularly are much less most likely to be included in a collision or other damaging event. Cars with lower yearly gas mileage might get slightly reduced rates.

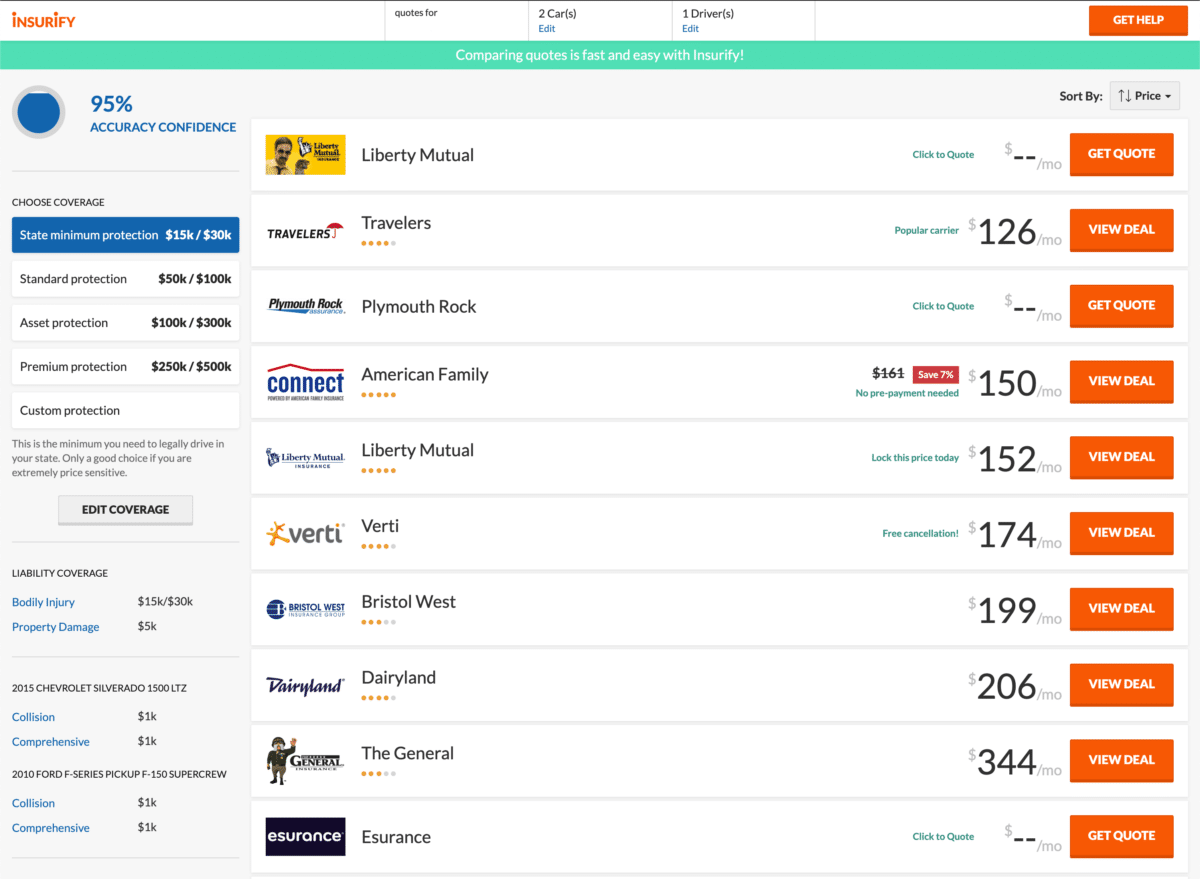

To find the very best car insurance coverage for you, you ought to contrast shop online or speak with an insurance coverage agent or broker. You can, however make certain to maintain track of the insurance coverages picked by you and supplied by insurance providers to make a fair contrast. Alternatively, you can who can help you locate the ideal mix of rate as well as fit (liability).

Independent agents function for numerous insurance companies and can contrast amongst them, while captive representatives benefit only one insurance provider. Provided the different rating methods as well as factors utilized by insurers, no single insurance coverage company will be best for every person. To much better recognize your common cars and truck insurance coverage cost, invest time contrasting quotes throughout companies with your selected technique.

These are example rates and need to just be made use of for comparative objectives. Rates were calculated by evaluating our 2021 base account with the ages 18-60 (base: 40 years) used. Depending upon age, vehicle drivers might be Hop over to this website a tenant or property owner. Prices for 18-year-old are based on a driver of this age that is an occupant (not a home owner) and also by themselves plan.

auto insurance auto affordable auto insurance car insurance

auto insurance auto affordable auto insurance car insurance

Washington State currently permits credit history as a score aspect, yet a restriction on its use is currently on hold in the courts (prices).

Car Insurance Rates By Make And Model 2022 - Finder.com - Truths

Four points to take into consideration when selecting the amount of coverage for your requirements: The value of your properties What you drive Exactly how much you drive That remains in the auto with you In many states, you're needed to lug a minimum quantity of obligation insurance policy and additionally give proof of insurance prior to you can register your vehicle or renew your chauffeur's license.

If that holds true, the legally accountable driver will certainly have to pay the additional expenditures out of pocket. Take into consideration the following when selecting Cars and truck insurance coverage:.

That's how easy it is. With My, Policy, you can see your policy online and make modifications or revivals. Utilize our acclaimed The General instinctive mobile application to execute these same jobs or sue. Do I obtain a price cut if I pay my plan in complete? In the majority of states, clients paying completely obtain discounts.

The cost of auto insurance policy can be complicated, so for many chauffeurs, it's an alleviation to be able to pay in monthly installments for the year. While this may appear like one of the most practical choice, it's not constantly one of the most cost effective over time. laws. Many insurance provider offer you the choice of spending for the entire policy yearly or spreading out the settlements over every month, however which is the most effective option? Well, it completely depends upon your conditions.

This is exceptionally handy to people that have revenue that fluctuates throughout the year or is seasonal, obtain a yearly benefit, or get a tax obligation refund. insure. It can additionally be practical for individuals who have difficulty staying on par with month-to-month settlements. Paying the insurance coverage premium annually might conserve you money if you normally sustain late costs.

Some Ideas on Car Insurance Monthly Or Yearly How To Get The Best Auto ... You Need To Know

insurance companies cheapest auto insurance business insurance car

insurance companies cheapest auto insurance business insurance car

Many companies bill an installment fee for this ease given that it takes even more job on the business's part to procedure 12 payments instead of simply one. Despite a monthly cost, paying in monthly installations is a much better option for some people. It enables you to spread out the price of the costs out with time as most individuals budget plan their money on a regular monthly basis.

affordable auto insurance cheapest cars low cost auto

affordable auto insurance cheapest cars low cost auto

If you anticipate a major modification in your policy prior to the year is up, like getting rid of a teen driver from your policy, you'll desire the capacity to take them off the plan and see instant savings. Month-to-month payments might likewise be a great selection for a person who may have the money to pay an annual costs but wishes to invest the extra cash or use it for another huge expenditure (cheap car).

Monthly: The Price Difference So which method is ideal for you? Obviously, it depends mostly on your economic circumstance and also comfort degree. An additional determinant is the amount of financial savings you'll enjoy if you do make a lump sum settlement. For example, it may not be worth it if you conserve $30 a year in charges.

Some companies also give you a discount if you established automatic payments with them. Not just can this choice get you a price cut, however you'll never ever have to stress about paying that costs every month. Usually the price cut you obtain for electronic or automatic repayments offsets any kind of installation fees you might pay each month, so if you're dithering in between annual or month-to-month payments, discover out if any one of these discounts is offered (insurance company).

Eventually, you wish to find a payment technique for your automobile insurance that develops a balance in between conference personal preferences as well as conserving you the most cash while offering you the automobile insurance policy security you need.

About Average Car Insurance In Ontario By Month, Age And Gender

The typical expense of automobile insurance in the United States is $2,388 each year or $199 monthly, according to data from virtually 100,000 policyholders from Savvy (cheaper). The state you live in, the degree of insurance coverage you would love to have, and also your sex, age, credit scores background, as well as driving history will all variable right into your costs.

Insurance coverage is controlled at the state level, and laws on called for protection as well as prices are different in every state. Insurance business take right into account many various aspects, consisting of the state and also location where you live, as well as your gender, age, driving background, and also the level of protection you would certainly like to have.

cars vehicle insurance low cost credit

cars vehicle insurance low cost credit

Here are the greatest aspects that will affect the rate you'll pay for protection, and what to take into consideration when taking a look at your vehicle insurance options. There have been some big changes to vehicle insurance policy costs during the coronavirus pandemic. Some automobile insurance providers are supplying price cuts as Americans drive less, and also are also helping individuals affected by the infection delay repayments.

Business Expert assembled a list of average automobile insurance coverage prices for each and every state. These prices were determined as a standard of rates reported by Nerdwallet, The Zebra, Worth, Penguin, Bankrate, and the National Association of Insurance Commissioners. Here's a range auto insurance costs by state. Source: Data from Nerdwallet, Value, Penguin, Bankrate, The Zebra, and the National Organization of Insurance Coverage Commissioners.

And from Company Expert's data, car insurer often tend to bill females more. Company Insider accumulated quotes from Allstate and State Farm for fundamental insurance coverage for male as well as women chauffeurs with a the same profile in Austin, Texas (credit score). When switching out just the gender, the male account was quoted $1,069 for protection each year, while the female account was quoted $1,124 per year for protection, setting you back the woman driver 5% more.

Some Of Average Car Insurance Rates By Age And State (May 2022)

In states where X is a gender alternative on chauffeur's licenses including Oregon, California, Maine, and quickly New York insurers are still figuring out how to calculate expenses. Average vehicle insurance coverage costs by age, The number of years you've been driving will certainly influence the cost you'll spend for coverage. While an 18-year-old's insurance standards $2,667.

This data was supplied to Company Expert by Savvy. Just how car insurance rates change with the number of autos you have, In some means, it's sensible: the a lot more cars and trucks you carry your plan, the greater your auto insurance expenses. However, there are also some cost savings when several automobiles get on one plan.

Car insurance coverage is more affordable in zip codes that are more country, and the very same is true at the state level. Guarantee. com data shows that Iowa, Idaho, Wisconsin, and also Maine have the most inexpensive automobile insurance coverage of all states, and that's because they're a lot more country states. Various other aspects that can affect the price of automobile insurance coverage There are a couple of other aspects that will add to your premium, including: If you do not drive several miles per year, you're less most likely to be associated with an accident.

Each insurer takes a look at every one of these elements and rates your protection differently therefore. It's crucial to contrast what you're offered. Get quotes from numerous different automobile insurance business as well as compare them to ensure you're obtaining the most effective deal for you. Personal Money Reporter.

If you're driving, you also require to have cars and truck insurance coverage. No one believes about shopping for vehicle insurance coverage.

Top Guidelines Of How Much Does Car Insurance Cost In May 2022? - Cnet

also if it's not the least expensive. The straightforward reality is, vehicle insurance policy for university pupils can make up a huge component of your limited budget. And auto insurance coverage rates alter regularly. The "great offer" you obtained as an university fresher might be a negative bargain today. Plus, the ordinary cost of cars and truck insurance for a two decades old is $3,816 per year, or $318 per month! That's a great deal of cash! That's why it's crucial that you search and seek the best automobile insurance coverage prices.

That's the average for every person. The ordinary price for university pupils is about $3,816 per year, or $318 per month.

This settlement might impact how as well as where products show up on this website (consisting of, as an example, the order in which they appear). The University Financier does not consist of all insurer or all insurance policy provides offered in the market. Our # 1 pick for the most inexpensive vehicle insurance policy for college students is Freedom Mutual The factor could surprise you.

And also by incorporating your plans, you can conserve huge bucks AND obtain more of what you require. When you combine vehicle insurance with tenants insurance, you obtain a multi-policy discount, which conserves you a whole lot of money. At Liberty Mutual, while prices vary, that can be a significant reduction. With that said, we suggest Freedom Mutual as our top pick for the most affordable overall automobile insurance for college students.Lemonade is one of our top options due to the fact that it combines whatever you require- automobile insurance coverage, tenants insurance, as well as much more -right into a simple item that you can get as well as get covered online. If you survive or near school, and also only drive during the summertimes and maybe some arbitrary journeys, why are you paying for automobile insurance coverage all year? Conserve some cash, and check it out. Review our complete Metromile testimonial right here. Contrast Total Car Insurance Coverage For University Student, Right here's our full comparison list for cars and truck insurance coverage for university student (automobile). Enter your postal code listed below and also obtain begun to discover the most affordable price near you. Biggest Elements To Consider When Purchasing Cars And Truck Insurance Coverage, Purchasing for cars and truck insurance policy is hard because there are many variables entailed in what cost you pay. If you already got in some info over, you might be surprised by the results. As well as the reality is, the insurance provider have done the mathematics. They understand the risks of every location, vehicle, driving habit, and extra. When it comes to searching for auto insurance as an university student, ensure you take into account the complying with aspects: Just how much Insurance Coverage Do You Actually Required? Some plans will certainly attempt to oversell you on coverage. Metromile is a pay by mile vehicle insurance provider. If you're driving less than 5,000 miles each year, you might be savingupwards of $500 or more per year by changing. This is a fantastic remedy for vehicle insurance for pupils since if you're on university 9 months a year, you might not need to be investing a lot of money on insurance coverage. These insurance policy plans are"attachments", they cover you for the time you're using your car for job.